Event planners always have concerns about the safety and security of events. As an event organizer, there is always the possibility of accidents occurring during an event. And some accidents might even lead to lawsuits which usually lead to even more costs. Therefore, the best way to be prepared and protected is to be insured.

What is Event Insurance?

There are different types of event insurance coverage, and event managers can purchase the most relevant coverage for their needs. Event insurance provides general liability coverage for events, and like any insurance, it also protects its owners from any financial losses. During an event, accidents may happen. And accidents can range from small damages to disasters or any other force-majeure. Therefore, it would be wise to consider having your event insured in order to prevent any high-risk losses.

Why you need event insurance.

Events bring people from different places together. Both, the guests and event organizing crew will be in one place, and insurance that covers both parties is necessary. Event insurance will protect both, guests and staff, from any loss and/or damages. Accidents happen, and they can cause a lot of stress. For example, if an important item is broken or damaged during an event, the insurance will cover it. No problem.

What does the event insurance cover?

- Third-Party Damage Insurance

- Public Liability Insurance

- Employers Liability Insurance

- Waiver of Subrogation

- Third-Party Damage Insurance

- Hired Auto Liability Insurance

- Worker’s Compensation Insurance

- Terrorism Insurance

- Special Event Insurance

Event Cancellation Insurance

The main fear of every event-organizer is event cancellation. How to cover the expenses spent on an event in the case of a cancellation?

Event cancellation insurance is a type of event insurance that covers a net loss in case of accidental cancellation or rescheduling.

What can be covered?

- Rescheduling costs

- Cancellation of speakers or performers

- Compensation for reduced attendance

- Reimbursement of the event itself

Cancellation insurance can also protect event planners from various risks and accidents related to cancellation or any other unexpected cases during the event time.

General Liability Coverage.

Imagine the following scenario. You are hosting a dinner in a famous museum, and as a staff member pops open a champagne bottle, the cork flies off towards an expensive artefact, causing it to break. What would you do? In this case, having insurance for your event can save you from suffering great costs. The insurance would be required for both the event organizer and the owner of the venue.

Event Vendor Insurance Coverage.

On some occasions, organizers work with vendors in events. Despite vendors being primarily responsible for their merchandise and products, organizers are also responsible for any losses and/or damages that vendors might incur. As such, event managers should ensure that the vendors they work with have proper insurance coverage.

Liquor Liability Insurance.

General Liability insurance doesn’t include claims related to the sales of alcohol. If your event sells alcohol, you need this insurance. If you produce and sell alcohol, you have to double-check a Liquor Liability Insurance in a General Liability.

What are the most unusual types of coverage?

In the digital era, what unexpected losses or damages may occur? Don’t forget about the online presence of the event and the necessity of being protected against cyber attacks. To protect yourself from any possible cyber attack, you can purchase a special insurance. The most efficient way is to collaborate with a trusted event tech provider and make sure that no one will break into your event systems to steal, change or destroy information. Another example is professional indemnity insurance, which covers loss or lawsuits in the case of customers’ dissatisfaction.

Another type of event insurance can be wedding insurance or award insurance, or so-called special event insurance. These are specific coverages considering such events are usually for top sellers and luxury segments. Also, private events with celebrities and honored guests might have some special requirements about the level of security and insurance.

Property insurance is the next type of insurance we would like to pay attention to. It covers any type of equipment or any other property possessions you need at the event venue. An onsite setup, especially for large-scale events, requires a range of equipment from tables to expensive hardware. It’s an essential requirement that every event organizer should have in order to be protected from any unexpected losses and/or damages.

How does it work? And what to do during an insured accident.

Organizers should be proactive when it comes to safety planning. In case of accidents, organizers should report the incident to the insurance provider and keep them informed about all relevant updates on the insurance case.

Things you need to know when purchasing event insurance.

Before purchasing the right event insurance, you need to consider the following issues:

Public Liability insurance – this is the coverage of possible effects caused to members of the public sector working at client sites or in public areas.

Employer’s Liability – this insurance covers any risks or damages that can occur with the event employees.

Some high-risk accidents are not covered – for example, horse-riding, fireworks, or other events related to extreme activities.

Read your policy – in some cases, your insurance can have exclusions, and you should be able to recognize such cases stated in your policy document.

How much does event insurance cost?

Depending on the location, the size of the event, and the venue, the price may vary. However, the general cost of event insurance in the US area is about $100-$200 per day.

How to evaluate the right level of coverage for event organizers.

Usually, event organizers review experience claims in order to see if there are any gaps and to try and make sure their policies meet the needs of their customers. Event planners should also ask visitors or vendors to read an event policy document carefully to understand possible coverage.

Choosing the right insurance provider.

It is crucial to choose the right insurance provider for the right event. Some companies are not reliable and can end up taking your money by finding ways to avoid coverage for serious accidents that you might incur in your event. Good providers enable you to get insurance for the event online very fast. In our digital era, you can get insurance with just a few clicks. Be particular and careful while selecting a provider by reading their policy documentation, where insurance coverage and exclusion should be stated.

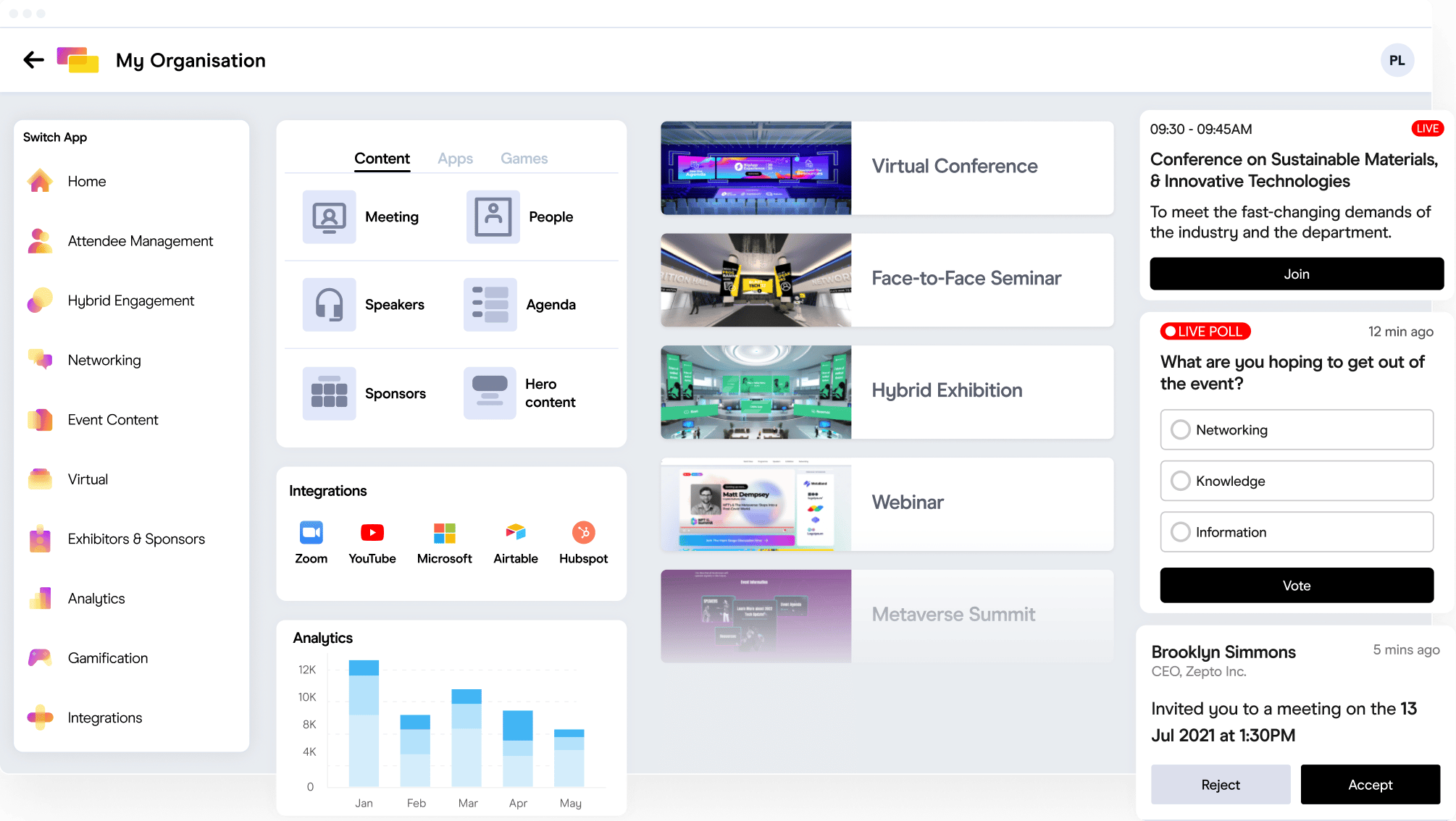

GEVME is a full-cycle event management platform to drive event business growth, which provides advanced security features. Mainly, this is related to the online security of the event. Request a DEMO to experience the automation of website development, online registration, onsite check-in and related services.

Wrapping Up.

Security and safety are key points to a successful event. To reduce stress for event-organizers by being protected from any possible losses, insurance for an event is a crucial part of event planning. If you are an event manager, make sure your event is covered and you are protected against any possible unexpected incidents.